The Process

Summary

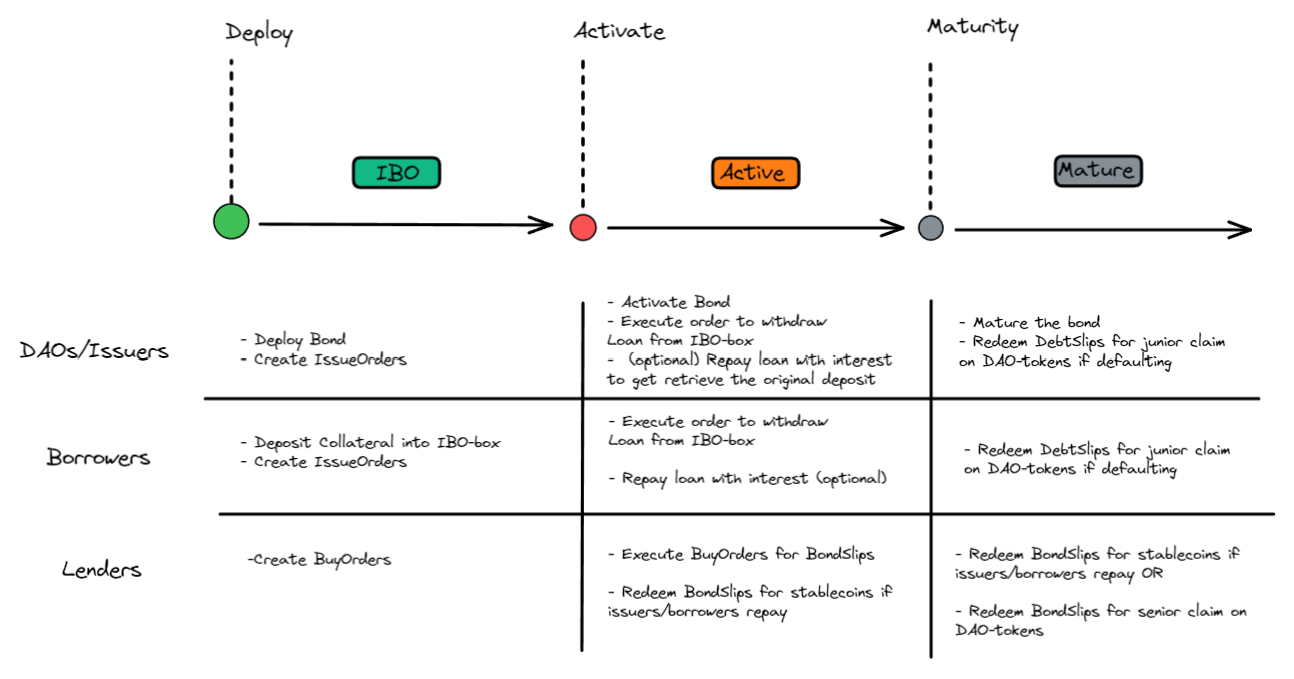

The following chart summarizes the process and the steps required by different participants.

1. Deploy and hold IBO

The first phase of the bond-process is the IBO. The IBO phase is zero-commitment. (i.e. the DAO can deploy a Bond & IBO without actually moving any of their DAO-tokens into the IBO-Box until they are confident with the lending demand).

The IBO-Box acts as an refundable escrow until the bond is ready to be activated. The DAO should have the following information to deploy an IBO-Box:

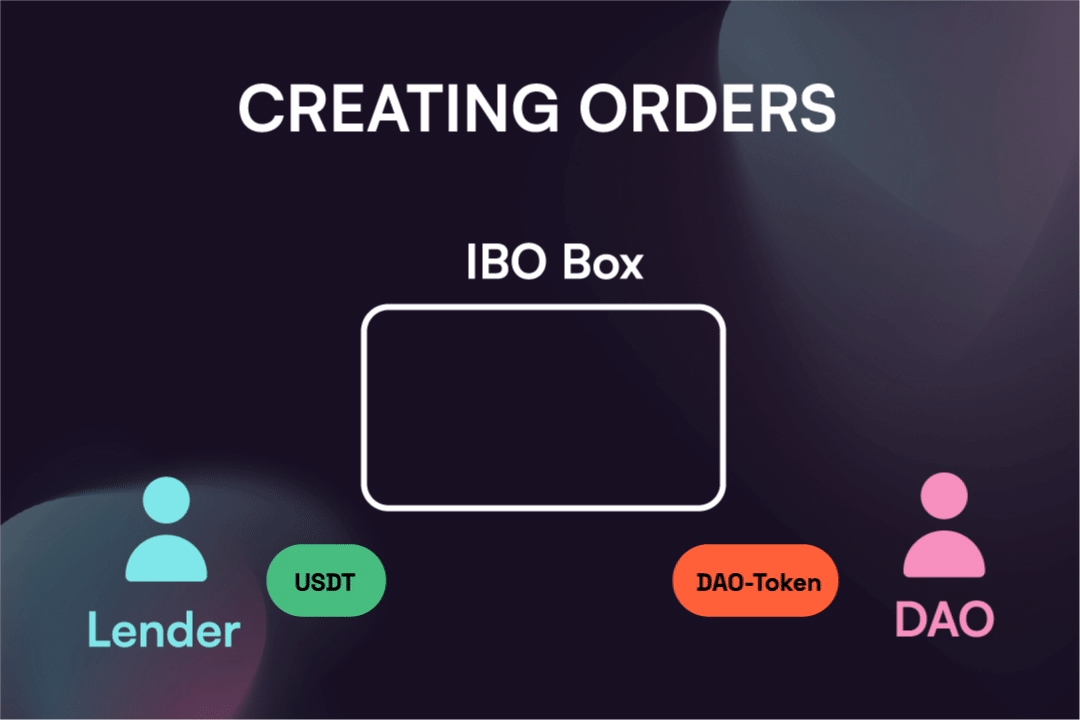

Once the IBO-Box is deployed, the DAO can create "IssueOrders" by depositing their collateral and lenders can create "BuyOrders" by depositing their stablecoins. Orders can be canceled before bond activation by burning the order for the underlying token.

It's encouraged for DAOs to advertise/market their IBO in their community channels in order to attract lending demand. There is no on-chain enforced end-date for an IBO, but it's encouraged for the DAO to have a date planned for either activating the bond, or retracting their deposit.

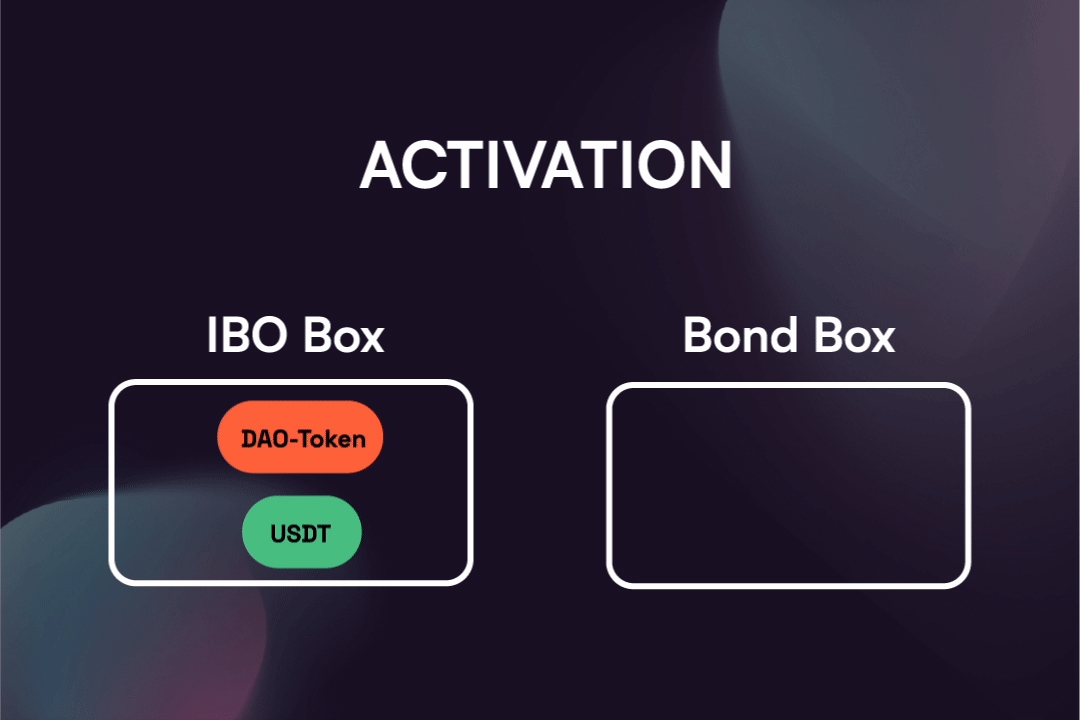

2. Activation

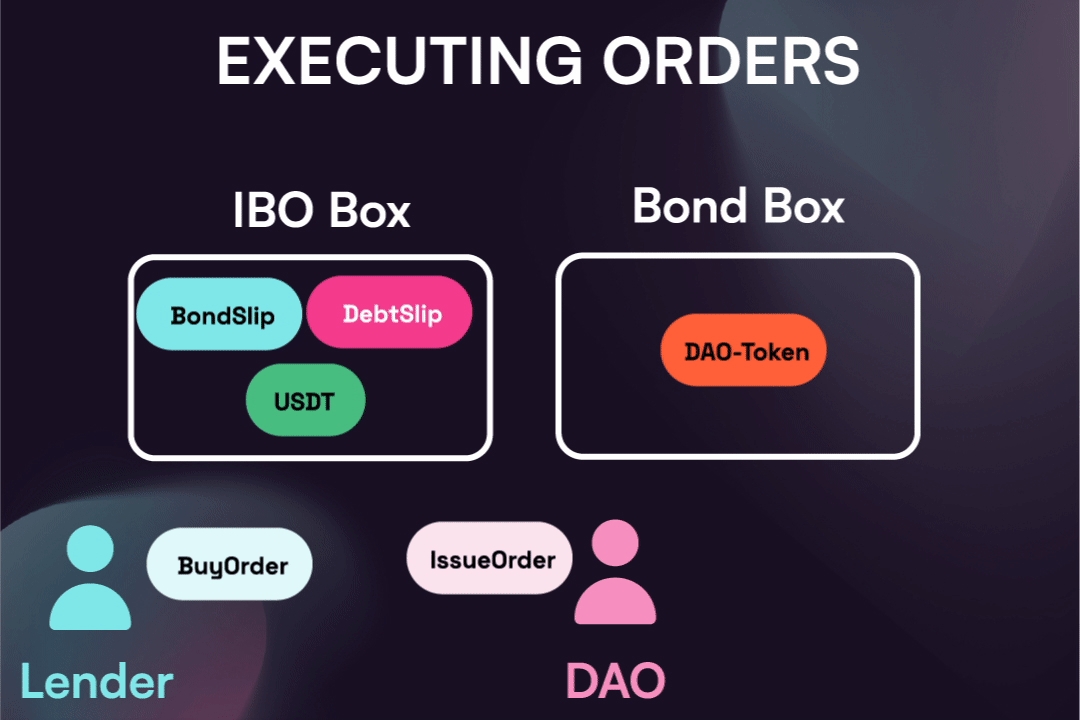

Once the DAO is satisfied with the IBO deposits, they can activate the bond. This will simultaneously issue the bond-slips to the IBO-box.

This will allow the DAO to execure their order token and withdraw the loan. Likewise, lenders can execute their "BuyOrders" to withdraw their BondSlips. If there was excess lending or borrowing demand, the unmatched orders will be able to cancel their order after bond-activation.

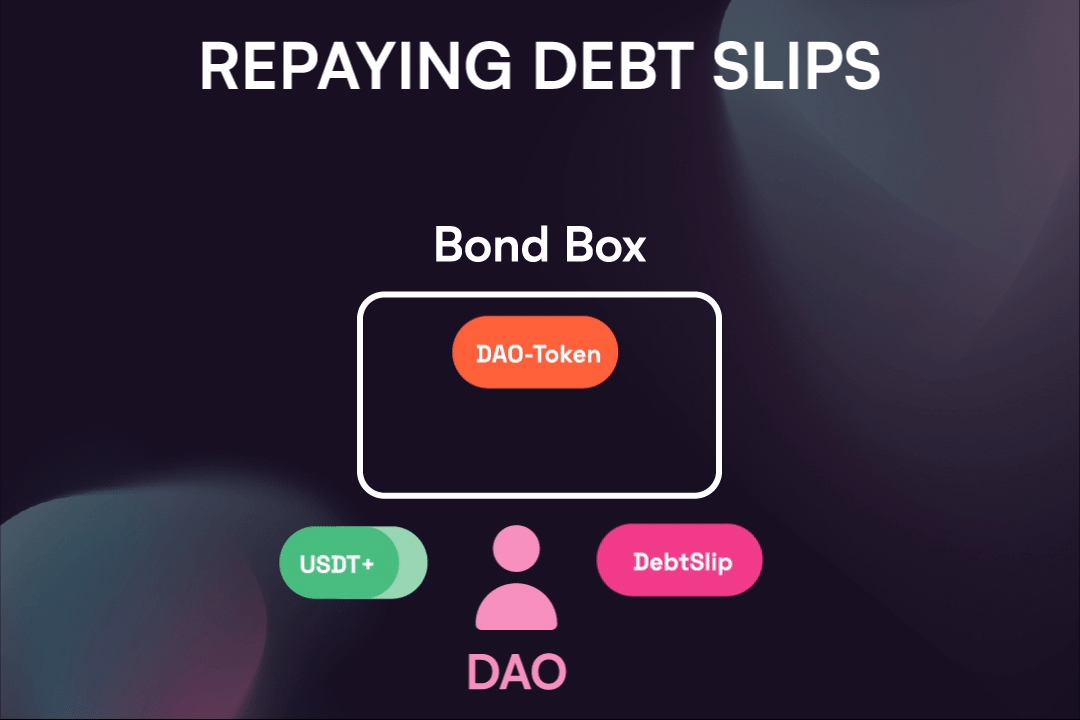

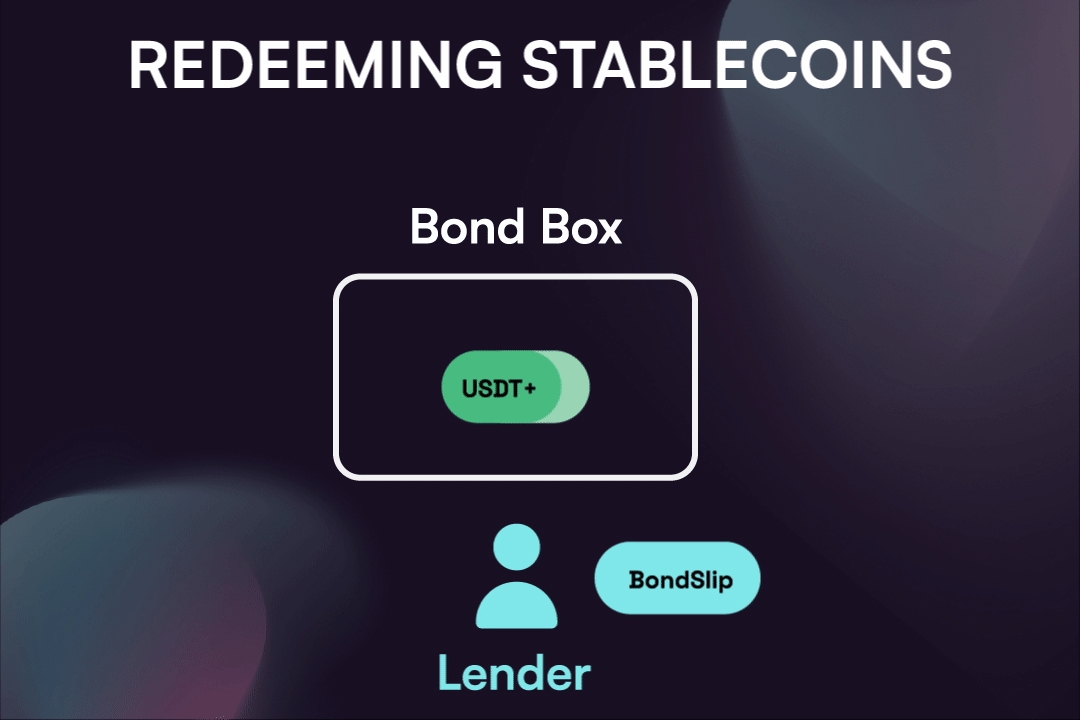

Once the bond is activated, the DAO can repay the loan at any time with the interest that has been accumulated. Bond holders can redeem the stablecoins any time after repayment.

The issuer can also set a fee on the bond-box. This fee is paid to the owner of the bond-box and represents a percentage of the claim when slips are either repaid or redeemed. This is useful when DAOs issue a bond and expect that there will be free-market participants looking to borrow against their token.

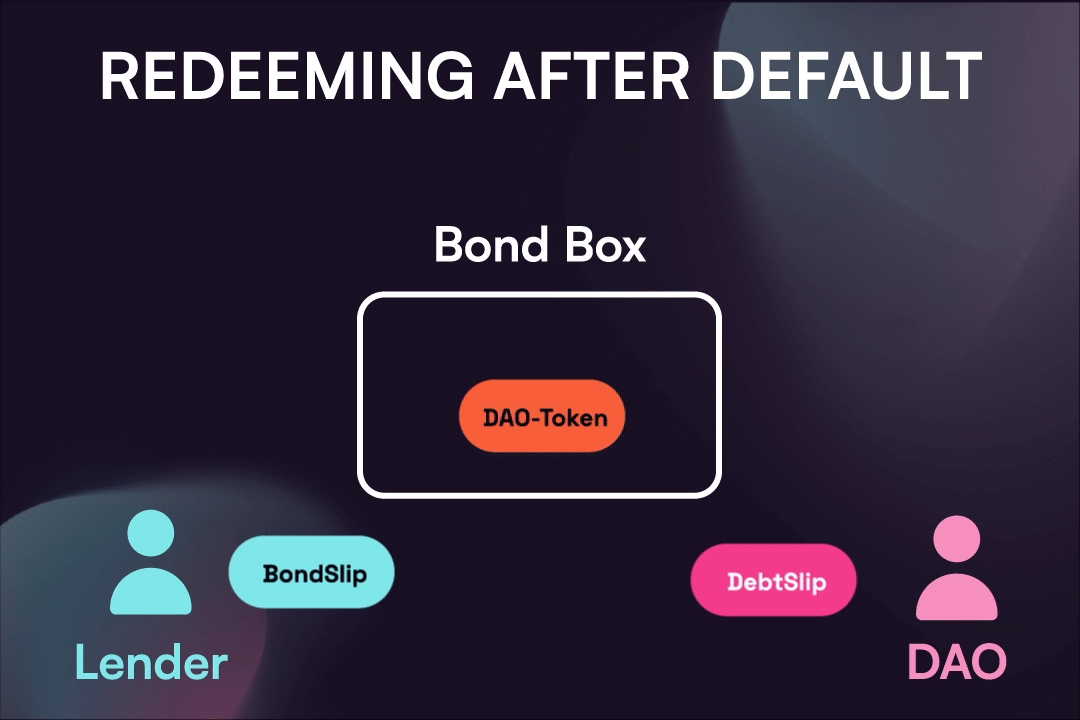

3. Maturity

Once the bond has reached maturity, bond-holders can redeem any slips that have not been repaid for DAO-tokens. If the issuer chooses to not repay the loan, they can redeem their slips for the junior tranche of the collateral minus the penalty.

Last updated