ConvertibleBondBox

The core contract that enables repayment of the loan

The Bond Box Contract will be responsible for the minting and burning of the BondSlip and DebtSlip tokens. Both the BondSlip and DebtSlip will be minted to a specified borrower & lender simultaneously in an “atomic deposit”.

It's important to note here that in order to make a deposit into the CBB, the caller must have the assets from both the lender and borrower.

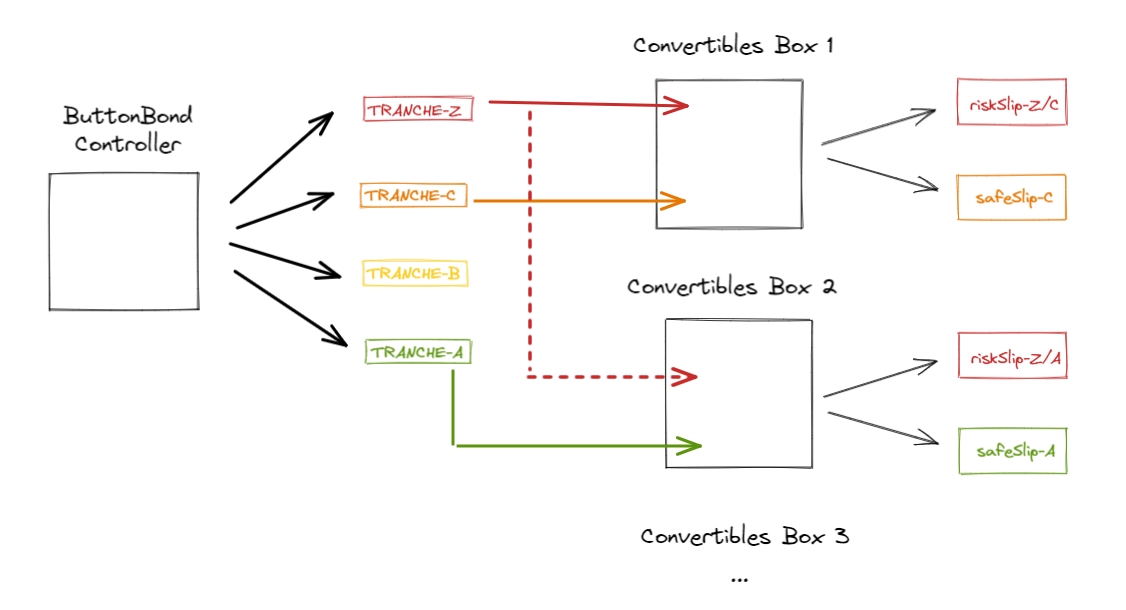

Similar to ButtonBonds, Convertible Bonds can come in a wide array of configs (i.e. different assets, different tranches). Therefore it makes sense to follow a similar deployment + instantiation pattern.

Key Immutables

The following is a list of the key attributes of any given ConvertibleBondBox:

Penalty

A ratio (between 0 and 1) that determines how much RiskTranche penalty is paid by borrowers in the event that they do not repay the loan. This is declared when the CBB is deployed via the factory.

Index of the SafeTranche

This indicates which tranche from the underlying ButtonBond is the "SafeTranche" for the purpose of the CBB. This is declared when the CBB is deployed via the factory.

InitialPrice

This is any arbitrary initial price (<$1.00) of the SafeTranche which is reflective of the interest rate over the term period. This price is set when the ConvertibleBondBox is re-initialized

Owner

This is the owner address of the CBB. They have the access to reinitialize the CBB, as well as set/change the fee.

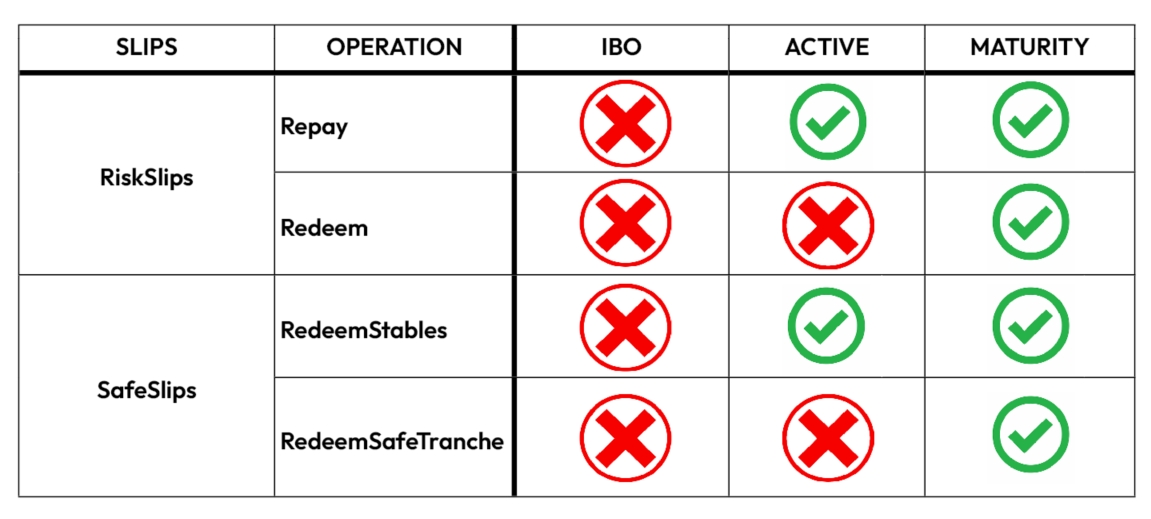

Using RiskSlips

Users (borrowers) holding RiskSlips have the option of the following actions:

Repaying the StableTokens in exchange of the underlying RiskTranche(Z) and SafeTranche

Redeeming for the underlying RiskTranche(Z) after maturity

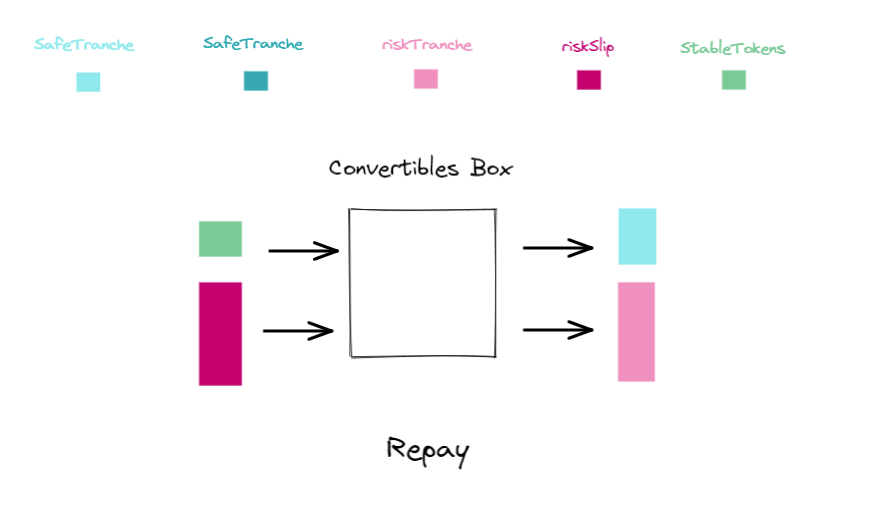

Repayment

Repayment can be done at any time after intialization of the CBB. The repayment price for each SafeTranche is scaled linearly as a proportion of the time remaining to maturity. At maturity, the price of the SafeTranche will be $1.

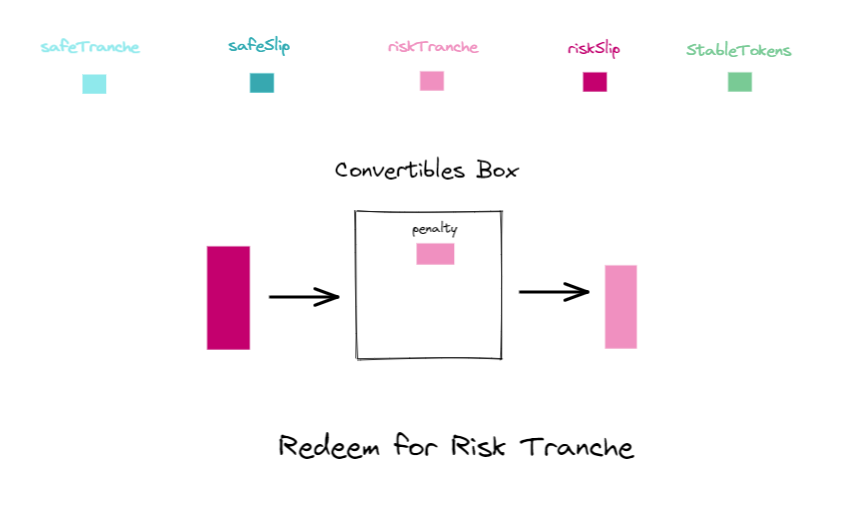

Redeeming RiskSlips (no repayment)

If the borrower does not want to or is unable to repay the loan, they can wait until maturity at which point they can redeem each RiskSlip for a RiskTranche minus any penalty parameter.

Using SafeSlips

Users (lenders) holding SafeSlips will similarily have the options to either of the following actions:

Redeem the SafeSlips for StableTokens

Redeem the SafeSlips for SafeTranche

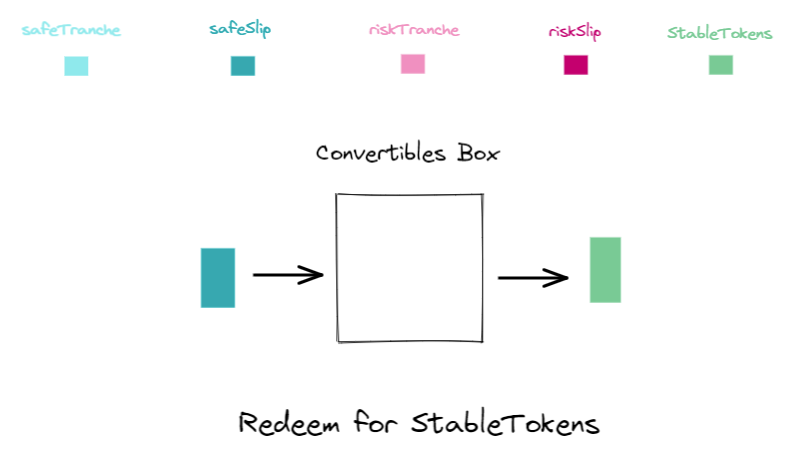

Redeeming for StableTokens

If the borrower has repaid the CBB with any stabletokens, the SafeSlips can be redeemed for the average repayment price. This can be done at any time post-IBO, as long as borrowers have repaid some stables.

Redeeming for SafeTranche

If borrowers have not completely repaid their loans by maturity, the SafeSlips can be redeemed 1:1 for a SafeTranche.

Summary

The chart below summarizes the options for slips at each phase.

Last updated