Analogies to TradFi

Callable & Convertible Bonds

In traditional finance, corporations have several tools at their disposal to raise capital. Two of which are convertible bonds and callable bonds. A convertible bond allows the holder to convert it into a predetermined number of shares. A callable bond allows the issuer to redeem the bond by repaying their debt before maturity.

HourGlass Bonds are an innovation on this concept. Our bonds behave like a callable bond before maturity and a convertible bond after. At maturity, any portion of the bond that has not been repaid can be converted into the tokens of the underlying collateral.

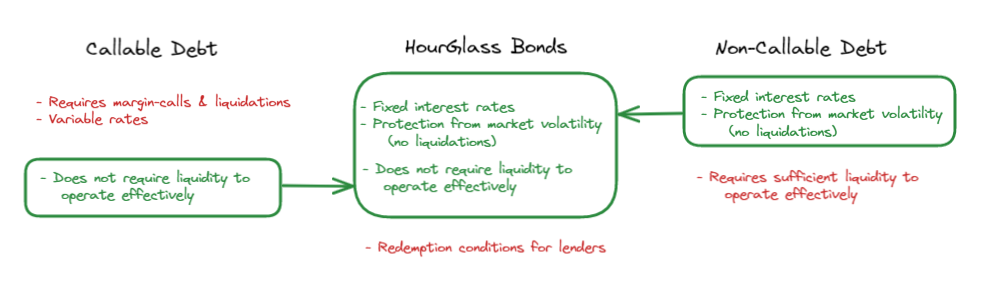

HourGlass bonds retain the benefits of both callable and non-callable debt. All this without the drawbacks of insufficient liquidity and margin-calls/liquidations.

Last updated